The Giants of Startup Acquisitions: How Tech Behemoths Are Shaping the Future

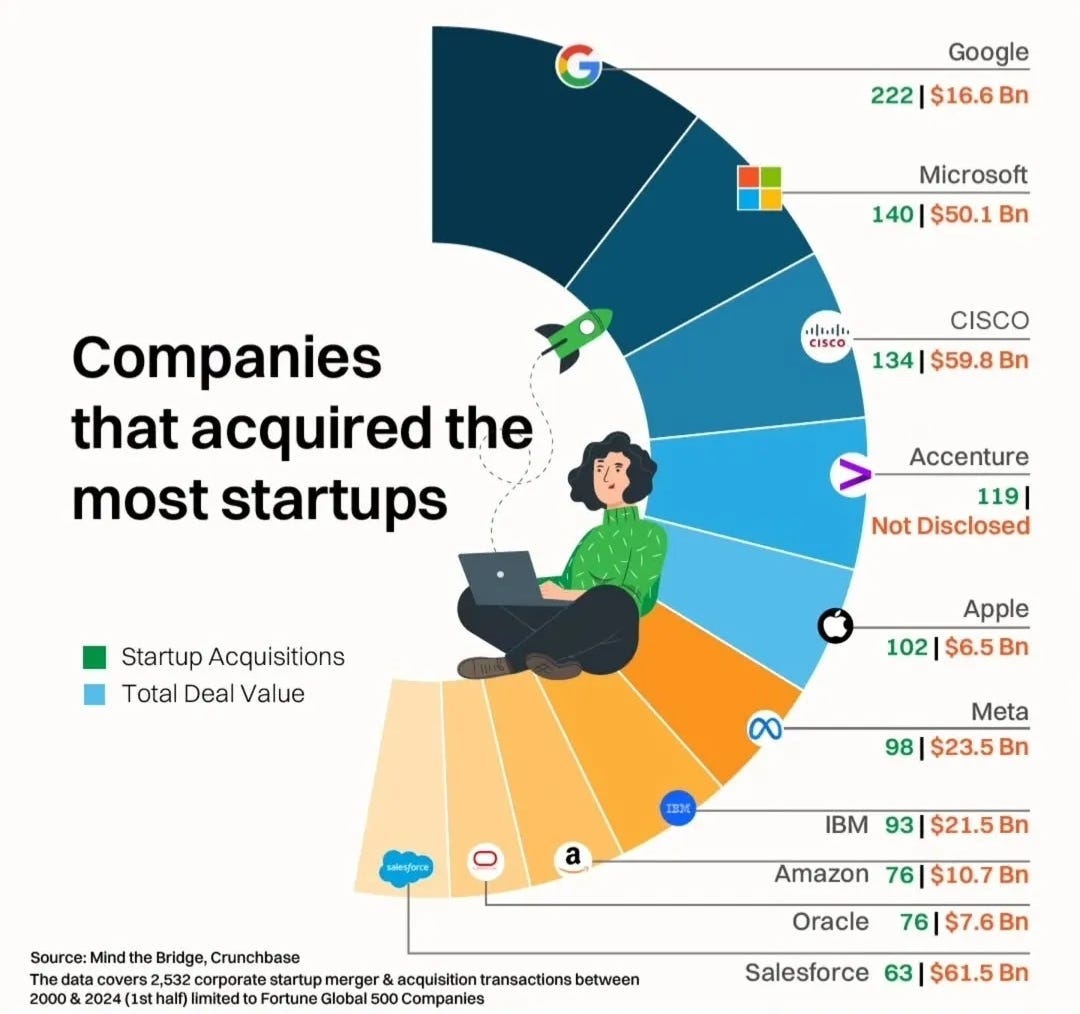

Over the last two decades, the biggest names in tech have been on a startup acquisition spree, reshaping industries and solidifying their dominance. According to recent data from Mind the Bridge and Crunchbase, spanning 2000 to 2024, the Fortune Global 500 companies are driving growth not just through organic innovation but by acquiring small, agile startups that bring fresh technologies and market potential.

Google: Leading the Pack with Strategic Acquisitions

Google tops the list with a staggering 222 startup acquisitions valued at $16.6 billion. This aggressive acquisition strategy highlights the company’s focus on expanding its product and service offerings, especially in AI, cloud computing, and digital advertising. Google has mastered the art of integrating small startups into its ecosystem, turning them into some of the most widely-used products in the world, such as YouTube and Google Maps. This strategic approach has helped the company stay ahead in a highly competitive market.

Microsoft: Big Acquisitions, Big Ambitions

Microsoft follows closely behind, with 140 acquisitions worth a significant $50.1 billion. Unlike Google, Microsoft’s acquisitions have focused heavily on professional networking and productivity tools. The purchase of LinkedIn in 2016 for $26.2 billion stands out as one of the company's largest deals and one that has helped redefine its role in the digital workplace. Microsoft’s other acquisitions, including GitHub and Nuance Communications, have reinforced its push into AI, cloud services, and software development, providing a clear path for future growth.

Cisco and Accenture: Investing in the Future of Networking and Consulting

Cisco, with 134 acquisitions totaling $59.8 billion, has been expanding its reach into the world of networking and cybersecurity. The company’s aggressive acquisition strategy is aimed at staying at the cutting edge of the evolving tech landscape, particularly as businesses continue to focus on securing their digital infrastructures. Similarly, Accenture has been on a steady path of acquiring innovative companies, adding 119 startups to its portfolio. Although the financial details are largely undisclosed, Accenture's acquisitions reflect its ambition to lead in digital transformation, consulting, and technology services.

Apple: A Cautious Approach to Acquisitions

Apple, in contrast, has taken a more reserved approach to acquisitions, acquiring 102 startups for a relatively modest $6.5 billion. Apple’s acquisitions tend to be more selective, focusing on companies that can enhance its hardware and software ecosystem. From artificial intelligence and machine learning to wearable technology, these strategic purchases enable Apple to remain competitive without sacrificing the company’s signature product design and user experience. While Apple doesn’t acquire as frequently, it chooses its targets carefully, integrating them seamlessly into its larger vision.

Meta: The Metaverse and Beyond

Meta, formerly Facebook, has been on a quest to shape the future of social interaction, investing $23.5 billion in 98 startup acquisitions. With its ambitious vision for the metaverse, Meta’s acquisitions in virtual reality (VR), augmented reality (AR), and social technology play a key role in positioning the company at the forefront of next-generation digital experiences. As the company doubles down on the metaverse, expect these types of acquisitions to continue, signaling a major shift in how we interact online.

Amazon, IBM, and Salesforce: Strategic Moves in AI and Cloud

Amazon, IBM, and Salesforce have each made significant moves in the startup world, albeit in different ways. Amazon, with 76 acquisitions worth $10.7 billion, has focused primarily on e-commerce and cloud technology. Acquiring startups that help improve its logistics, retail technology, and cloud infrastructure has kept Amazon ahead in an increasingly competitive marketplace.

IBM has followed a similar strategy, acquiring 93 startups valued at $21.5 billion. The company’s focus has been on artificial intelligence, data analytics, and cloud computing, helping it pivot from its legacy hardware and software businesses into more future-facing technologies.

Salesforce stands out with its $61.5 billion in acquisitions across 63 companies, making it a leader in the deal value category. Its aggressive push into customer relationship management (CRM) software and enterprise solutions through acquisitions has helped Salesforce solidify its position in the competitive SaaS (Software as a Service) market.

Why These Acquisitions Matter

These acquisition strategies are more than just numbers. They reveal the larger narrative of how these corporations are positioning themselves for the future. In a fast-moving tech world, buying smaller, innovative companies allows these giants to rapidly scale and adapt to new market demands. It also enables them to acquire the talent, technology, and intellectual property that would otherwise take years to develop internally.

For startups, this represents both an opportunity and a challenge. On the one hand, getting acquired by one of these companies can provide the resources, scale, and credibility needed to accelerate growth. On the other hand, it also means that the competition to attract attention from these tech giants is fierce.

The Bottom Line: Innovation is the Key

As these tech giants continue to acquire startups, one thing is clear: innovation is the driving force behind future growth. For emerging entrepreneurs and startups, this is a reminder that creating disruptive technologies, particularly in fields like AI, cloud computing, and cybersecurity, can open doors to the world’s largest companies.

The startup acquisition landscape is evolving quickly, and as these companies continue to reshape industries, it will be interesting to see what the next 20 years hold.